Exit Planning

What is it?

Exit planning is a process of developing a business owner’s strategy for an eventual exit from the business.

Every business owner exits from their business at some point, one way or another. Planning in advance gives you the best chance of exiting on your terms, at your preferred timeline, while leaving the business to your successor of choice! It’s worth remembering the Benjamin Franklin quote: “If you fail to plan, you are planning to fail!”

VARIOUS EXIT OPTIONS INCLUDE

Each of the following options has pros and cons and has different planning consideration. For instance, a succession plan requires not only identifying the right person (often a child or other family member), but also coaching and preparing them to be right leader for the organization that may be bigger and more complex by the time they finally take over the reins.

Transferring the business to employees could take various forms including a Leveraged Buyout, Employee Stock Ownership Plan (ESOP).

Selling to a third party requires many considerations depending on the type of business and the type of buyer.

FACTORS TO CONSIDER WHEN

DEVELOPING AN EXIT PLAN

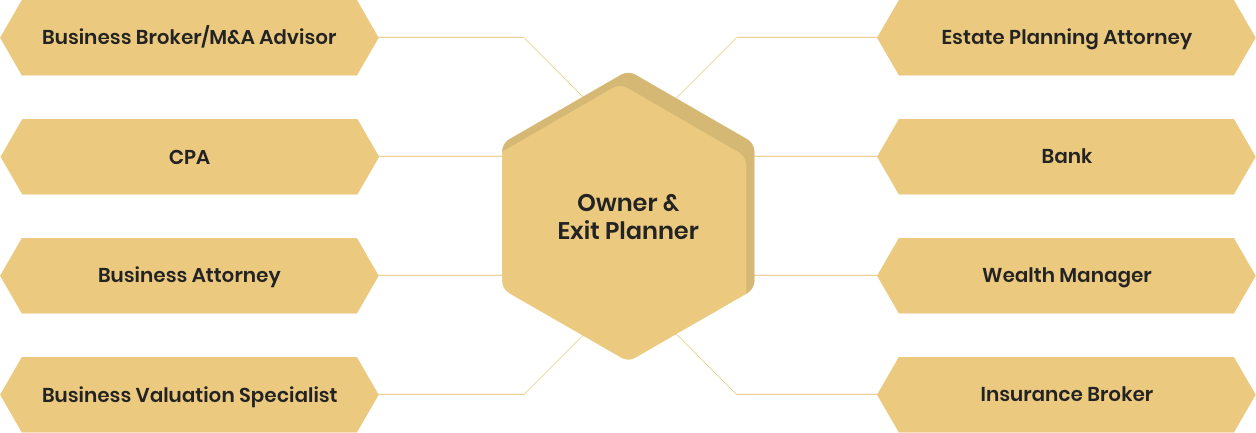

No one professional will have the expertise to advise you on all of these aspects. Besides, trying to address each area on its own by a separate professional without a coordinated and unified strategy to get you to your end goal can lead to conflicting ideas and less than optimal outcomes. A qualified Exit Planner can help coordinate all the efforts towards your desired exit objectives!

The right team is a vital part of any exit strategy and may include the following professionals.

DETERMINE WHERE YOU ARE AND

WHERE YOU WANT TO GO!

If retirement is your goal, a successful exit will need to ensure that your nest egg after accounting for the net proceeds from the sale of your business will meet or exceed your retirement needs

This requires that you start with an evaluation of your current net worth, estimate the size of your retirement nest egg including the after-tax proceeds from the sale of your business. Compare that with your needs after retirement to determine if there is a gap, and then set out to develop a plan to bridge that gap.

In order to estimate your proceeds from the sale of your business, which is often a business owner’s largest asset, it is important to obtain a valuation and not rely upon hearsay, or very rough industry estimates. After all, you don’t want to be surprised to learn that what the market will pay for your business is vastly different than what you expected.

VARIOUS METHODS OF VALUATION

There are various methods of business valuation, and the most appropriate methods for your business will depend on the type and size of your business.

- Dividend-paying capacity method

- Guideline Merged & Acquired or publicly- traded company method

- Transaction database method

- Discounted cash flow method

- Capitalization of excess income method

- Capitalized economic income method

- Net asset value method

- Adjusted net book value method

- Capitalization of excess income method (also an income approach)

Once you have a good estimate of the value of your business and have identified the gap between what your business is worth today and your exit goals, the next step would be to work on eliminating this gap by a combination of methods including working on the most viable value drivers of your business that can lead to a higher future valuation and more profitable operations in the interim.

In addition to boosting company values, these value drivers make the company more attractive to would be successors (third party buyer, or internal successor) by making the company easier to run, process oriented, and more likely to continue its history of success!

WORK ON VALUE DRIVERS &

OTHER STRATEGIES TO GET YOU TO YOUR GOAL

THINK ABOUT WHO YOUR TARGET BUYER WOULD BE

- Another Entrepreneur

- Industry Buyer

- Financial Buyer

- Strategic Buyer

These can be further divided into Private Equity Groups, Family Offices, Search Funds, Competitors, Vendors, Customers, or Businesses in related Industries that can benefit from your infrastructure, technology, products, service, or customer base.

Each group has different buying criteria and requirements. Working with a Business Broker or M&A Advisor that is experienced in reaching out and dealing with these different groups can help maximize your chances of a successful exit!

TIMING

There is a saying that entrepreneurs rarely sell too soon, but often sell too late.

Once you have decided on an exit path, and if that involves selling the business, you should consider selling when the business is doing well. Many sellers try to push this decision as far out into the future, and it is quite common to hear business owners say “just 5 more years”.

While I would never encourage owners to sell before they are truly ready, It is important to ensure that “5 more years” is based on a thoughtful plan rather than just a desire to kick the can down the road to avoid making decisions. Indefinite delays have lead many business owners of otherwise healthy and desirable businesses to get caught up in what our industry refers to as the dismal D’s.

- Death

- Divorce

- Disease

- Declining Sales

- Disability

- Drowning in Debt

- Dissention between partners

DEVELOP A PERSONAL VISION FOR WHAT COMES AFTER YOUR EXIT

Exiting a business can be a very emotional experience for many owners.

If you have owned the business for many years, your sense of identity is very closely tied to the business. It can feel like you’re selling your baby. After all, you’ve nurtured and grown the business with years of blood, sweat, and tears!

An abrupt exit from the business can lead to a sense of loss, and the very thought of it has caused many business owners to question their decision to sell. The best way to ensure a smooth transition to your new life chapter after exiting your business, is to have a clear idea about what you plan on doing with all your free time after selling.

Of course, there are no right or wrong answers here as it is a matter of personal preference. Some may spend a lot of on the golf course, or with their grand kids.

Others may take up a new hobby, or even a second career. It is all good as long as you are at peace with the idea and have given it some time to sink in.

WONDERING HOW YOU SHOULD GET STARTED?

Take this 15 minute Free Exit Readiness Assessment to receive a complimentary assessment report and analysis to help you begin the planning process.